Google Adsense Ads

অনার্স ৩য় বর্ষের আর্থিক ব্যবস্থাপনা সাজেশন 2025

| জাতীয় বিশ্ববিদ্যালয় অনার্স পাস এবং সার্টিফিকেট কোর্স ৩য় বর্ষের BA, BSS, BBA & BSC অনার্স ৩য় বর্ষের [২০১৩-১৪ এর সিলেবাস অনুযায়ী] আর্থিক ব্যবস্থাপনা (Financial Management) সুপার সাজেশন Department of : Accounting & Other Department Subject Code: 232513 |

| 2025 এর অনার্স ৩য় বর্ষের ১০০% কমন সাজেশন |

আর্থিক ব্যবস্থাপনা অনার্স ৩য় বর্ষ সাজেশন, চূড়ান্ত সাজেশন অনার্স ৩য় বর্ষের আর্থিক ব্যবস্থাপনা, অনার্স ৩য় বর্ষের আর্থিক ব্যবস্থাপনা ব্যতিক্রম সাজেশন pdf, অনার্স ৩য় বর্ষের ১০০% কমন আর্থিক ব্যবস্থাপনা সাজেশন

অনার্স ৩য় বর্ষ আর্থিক ব্যবস্থাপনা সাজেশন, honors 3rd year financial management special short suggestions, অনার্স ৩য় বর্ষ আর্থিক ব্যবস্থাপনা ১০০% কমন সাজেশন, Honors 3rd year suggestions

অনার্স ৩য় বর্ষের পরীক্ষার সাজেশন 2025 (PDF) লিংক

সর্বশেষ সংশোধিত ও সাজেশন টি আপডেটের করা হয়েছে 2025

আর্থিক ব্যবস্থাপনা অনার্স ৩য় বর্ষ সাজেশন 2025

ক-বিভাগ: অতিসংক্ষিপ্ত প্রশ্ন

1. What is investment decision?

Ans: The decision which involves the allocation of capital acquired to long term assets that would provide benefits in the future is called investment decision.

2. What is agency cost?

Ans: The costs borne by the stockholders to maintain governance structure that minimizes agency problems and contibutes to thevmaximization of owner walth.

3. What is agency problem?

Ans: When the conflict arises between the principles and agents is called agency problem.

4. What is financial management?

Or, Define financial management.

Ans. Financial Management is the operational activity of a business that is responsible for obtaining and effectively utilizing the funds necessary for efficient operations.

5. What is capital market?

Ans: The market where long term securities debt, bond and stocks are traded is called capital market.

6. What is risk?

Ans: Risk is the financial loss or more formally, the variability of returns associated with a given assets.

7. What is business risk?

Ans: Business risk refers to the associated with the firm’s operations. Its impact is shown in the variability of firm’s operating income (EBIT).

8. What is correlation?

Ans: An analysis of determining the relationship among variables is called co relation.

9. Elaborate RADR?

Ans: RADR-Risk Adjusted Discount Rate.

10. What is risk premium?

Ans: The excess return required from an investment in a likely assets from a risk free investment. over that required

11. What is indifference point?

Ans: The Indifference point is the level of EBIT (Earnings Before Interest & Tax) where EPS (Earning Per Share) is the same of two alternatives.

12. What is arbitrage process?

Or, What do you mean by arbitrage process?

Ans: The arbitrage process is the purchase of securities or assets whose prices are lower and sale of securities or assets whose prices are higher, unrelated markets which are temporarily out of equilibrium.

13. What is optimum capital structure?

Ans: The Capital structure that minimizes the firm’s cost of capital and thereby maximizes the value of the firm is called optimal capital structure.

14. What is arbitrage?

Ans: Arbitrage means finding two assets that are essentially the same, buying the cheaper and selling the more expensive.

15. What is debt capacity?

Ans: Debt capacity is the maximum proportion of debt that the firm can include in its capital structure and still maintain its lowest composite cost of capital.

16. What is price earnings (P/E) ratio?

Ans: The Price Earnings Ratio measures the amount that investors are willing to pay for each taka of firm’s earnings. The higher the P/E ratio, the greeter the investor level confidence.

17. What is flotation cost?

Ans: The costs which associated with issuing securities such as underwriting’ legal’ listing’ and printing fees.

18. What is hire purchase?

Ans: Hire purchaser is a types of installment credit under which the hire purchase angered to take the goods on hire Alerts rental which is inclusive of the repayment of the principles.

19. What is stock dividend?

Ans: A stock dividend means the payment to existing owners of dividend in the form of stock.

20. What is preferred stock?

Ans. Preferred stock is one kind of stock which gots priority to achieving dividend and capital back.

21. What is retention ratio?

Ans. Retention ratio the part or percentage of the net earnings which is retained.

22. What is underwriting?

Ans: Underwriting is the role of the investment bank is taking the risk of reselling at a profit the securities purchased from an issuing company at an agreed on price.

23. What is the elaboration of IPO?

Ans. IPO = Initial Public Offering.

24. What is money market?

Ans: Money market is a financial relationship created between suppliers of fund and demanders of short-term funds.

25. What is prospectus?

Ans: A prospectus suppliess information about a new security issue and the issuing company.

26. What is primary market?

Ans: The market where new sewrities are issued and sold directly by the issuer to investors.

27. What is initial public offering (IPO)?

Or, What is IPO?

Ans: Public issue is one of the most important way to collection of money from the capital market.

28. What is financing lease?

Ans: Financing Lease is a longer term lease than an operating lease that is non cancelable and 09 obligates the lessee to make payments for the use of 10 an asset over a predefined period of time.

29. What is operating lease?

Ans: Operating lease is a cancelable contractual arrangement where the lessee agrees to make periodic payments to the lesser.

30. What is lease financing?

Ans: Lease financing is the process by which a firm can obtain the proper use of certain fixed assets for which it must make a series of contractual, periodic, tax deductible payments.

| Honors Suggestion Links | প্রশ্ন সমাধান সমূহ |

| Degree Suggestion Links | BCS Exan Solution |

| HSC Suggestion Links | 2016 – 2025 জব পরীক্ষার প্রশ্ন উত্তর |

| SSC Suggestion Links | বিষয় ভিত্তিক জব পরিক্ষার সাজেশন |

আর্থিক ব্যবস্থাপনা অনার্স ৩য় বর্ষ সুপার সাজেশন PDF Download 2025

APart

- what is investment decision

- what is agency cost

- what is agency proble

- what is finance management

- what is capital market

- what is risk

- what is business Risk

- what is correlation

- elaborate CAPM

- what is ricsk adjusted discount rate

- elaborate RADR

- what is premium

- what is indifference point

- what is arbitage process

- what is optimum capital structure

- what is arbitage

- what is debt capacity

- what is price earning ratio

- what is flotation cost

- what is hire purchase

- what is stock dividend

- what is preferred stock

- what is retention ratio

- what is ubderwriting

- what is the elaboration of ipo

- what is money market

- what is prosectus

- what is primary market

- what is internal public offereing

- what is financing lease

- what is operatiob lease

- what is lease financing

- what is spontanceous financing

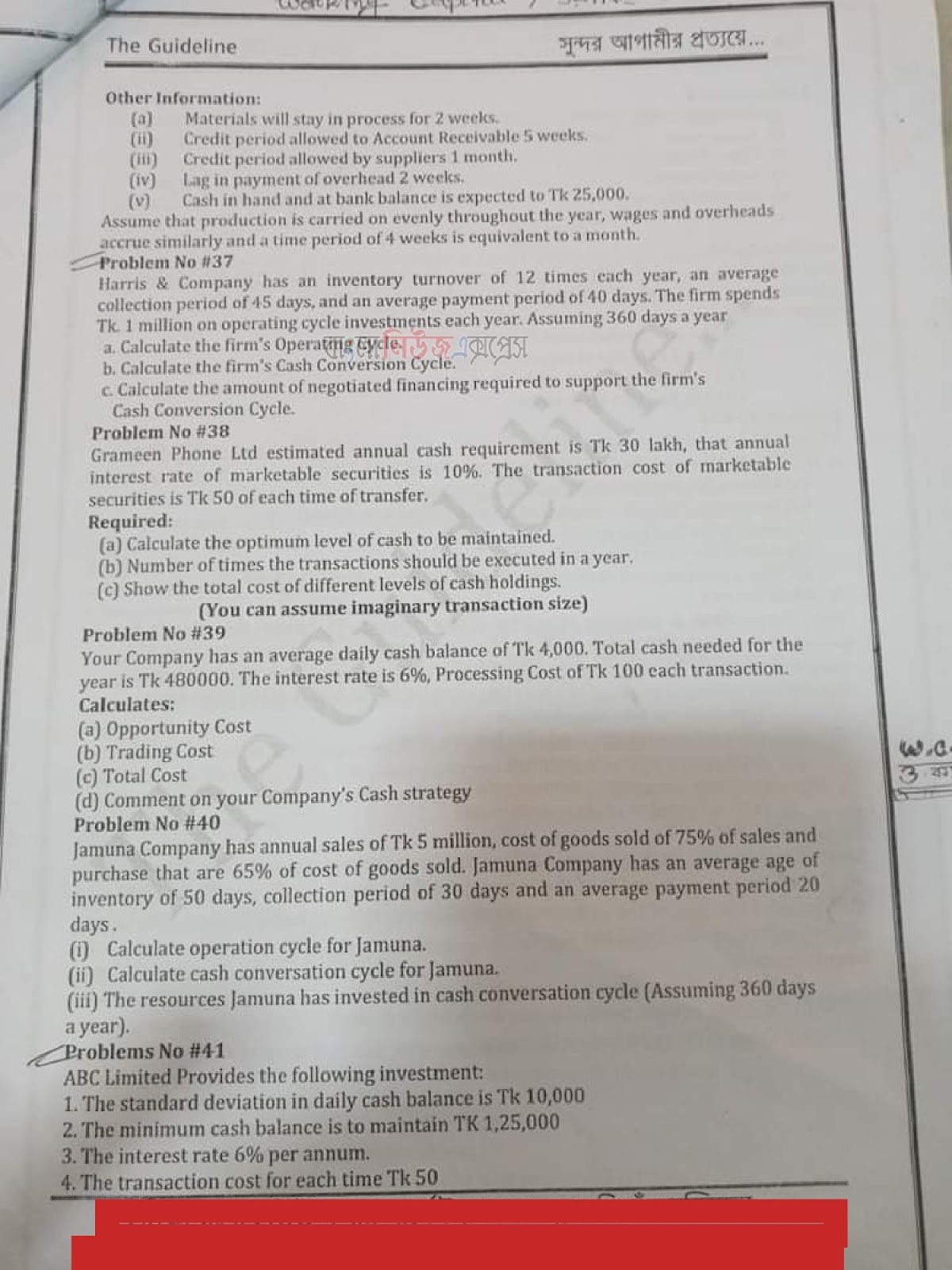

- what is working capital management

- what is net working capital

PDF Download আর্থিক ব্যবস্থাপনা অনার্স ৩য় বর্ষ সুপার সাজেশন 2025

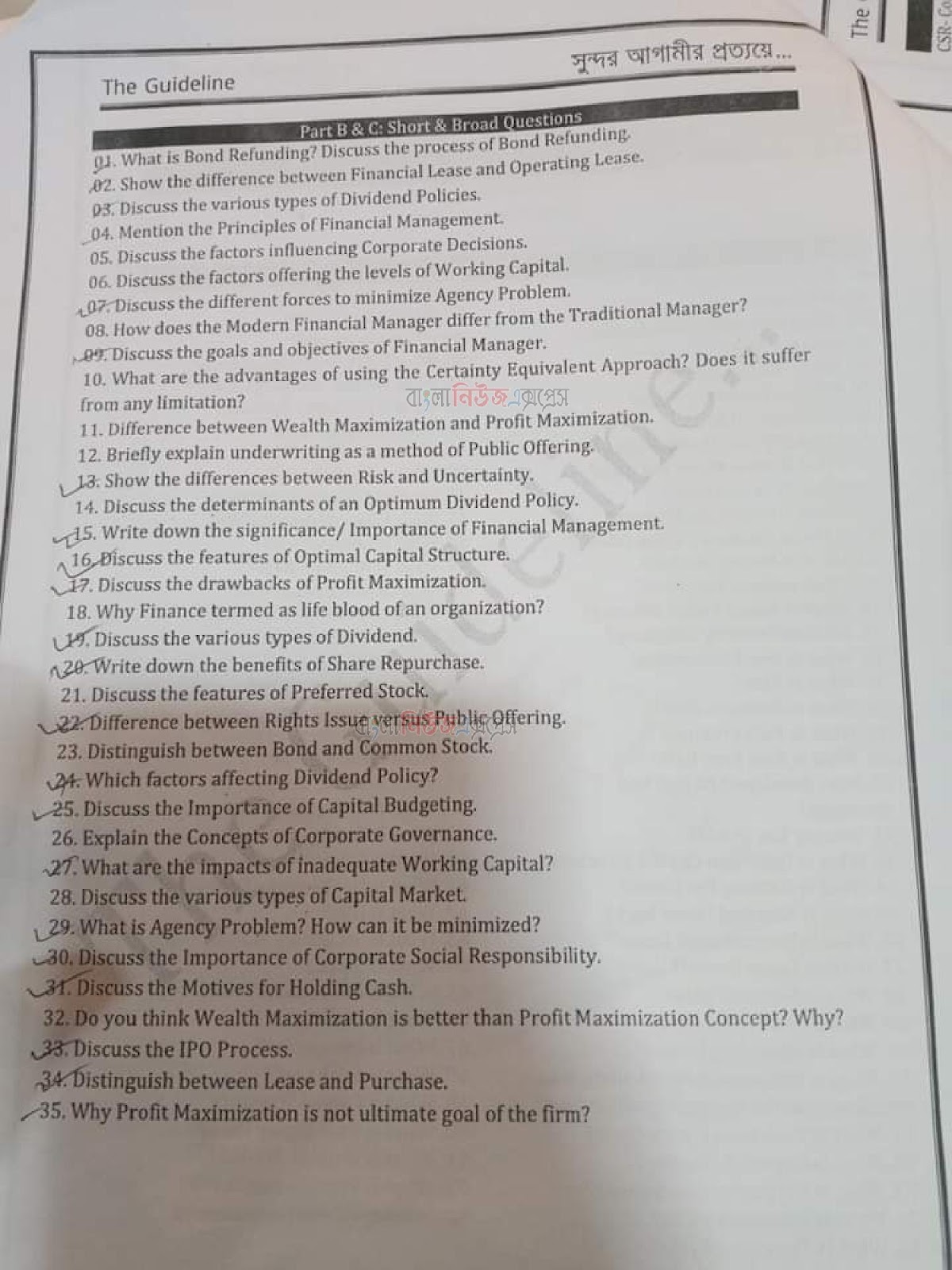

খ-বিভাগ: সংক্ষিপ্ত প্রশ্ন

1. Discuss the factors influencing financial decision.

Or, How many factors influencing financial decision.

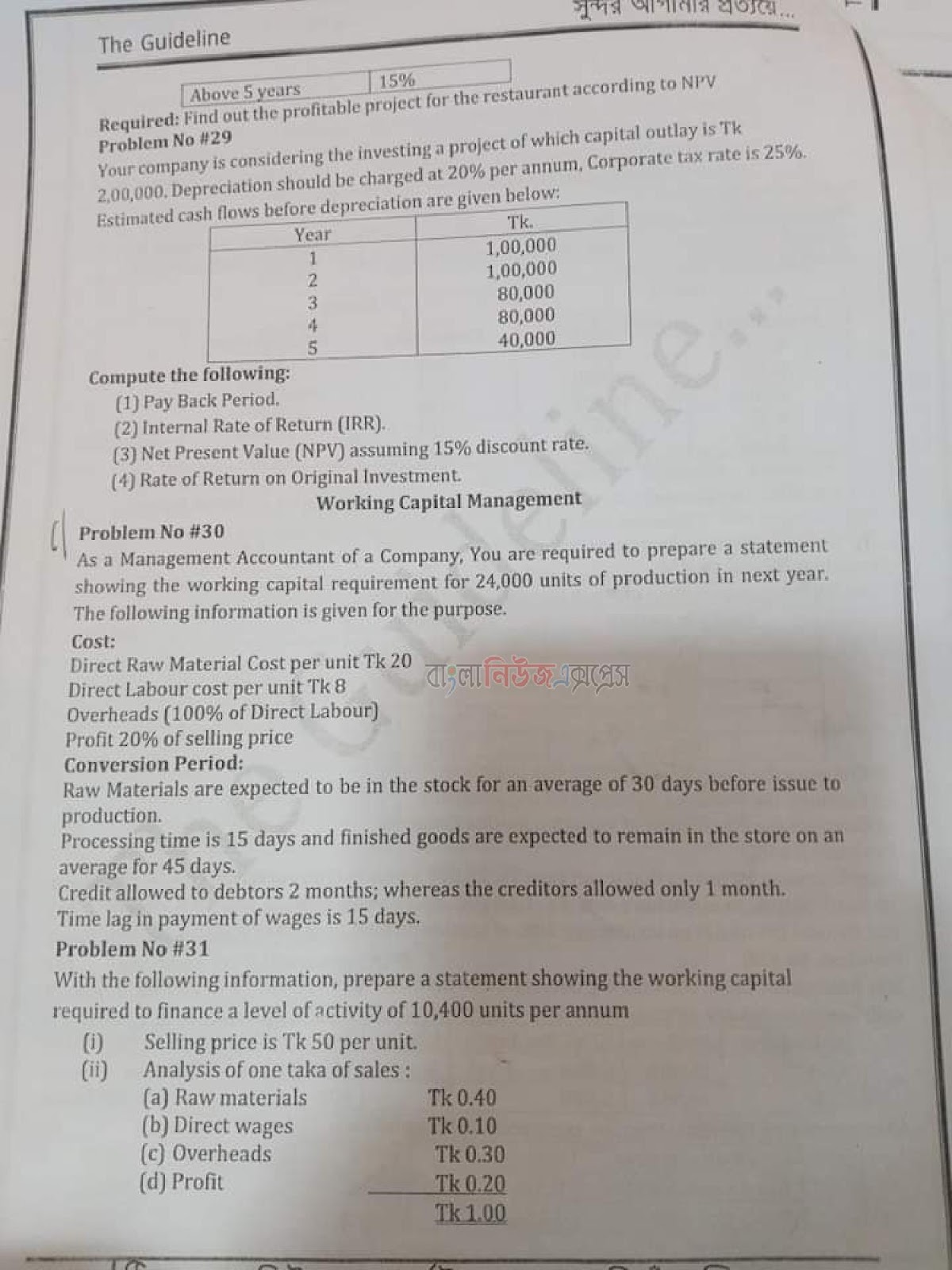

2. Discuss the importance of capital budgeting.

Or, Describe the advantages of capital budgeting.

3. Discuss in brief the techniques of capital budgeting.

Or, Discuss the techniques of capital budgeting?

Or, What are the techniques of adjusting risk in capital budgeting? Explain.

4. Describe in berief the external factors determining capital structure.

5. Which factors affecting dividend policy?

6. What is zero coupon bonds? Why do investors buy it although it has no coupon interest?

7. Distinguish between common bond and stock.

8. Explain best effort method and firm commitment method of underwriting.

9. Discuss different methods of lease.

10. Discuss the objectives of lease financing as organized in Bangladesh.

11. Explain the aggressive approach of working capital management.

[ বি:দ্র: উত্তর দাতা: রাকিব হোসেন সজল ©সর্বস্বত্ব সংরক্ষিত (বাংলা নিউজ এক্সপ্রেস)]

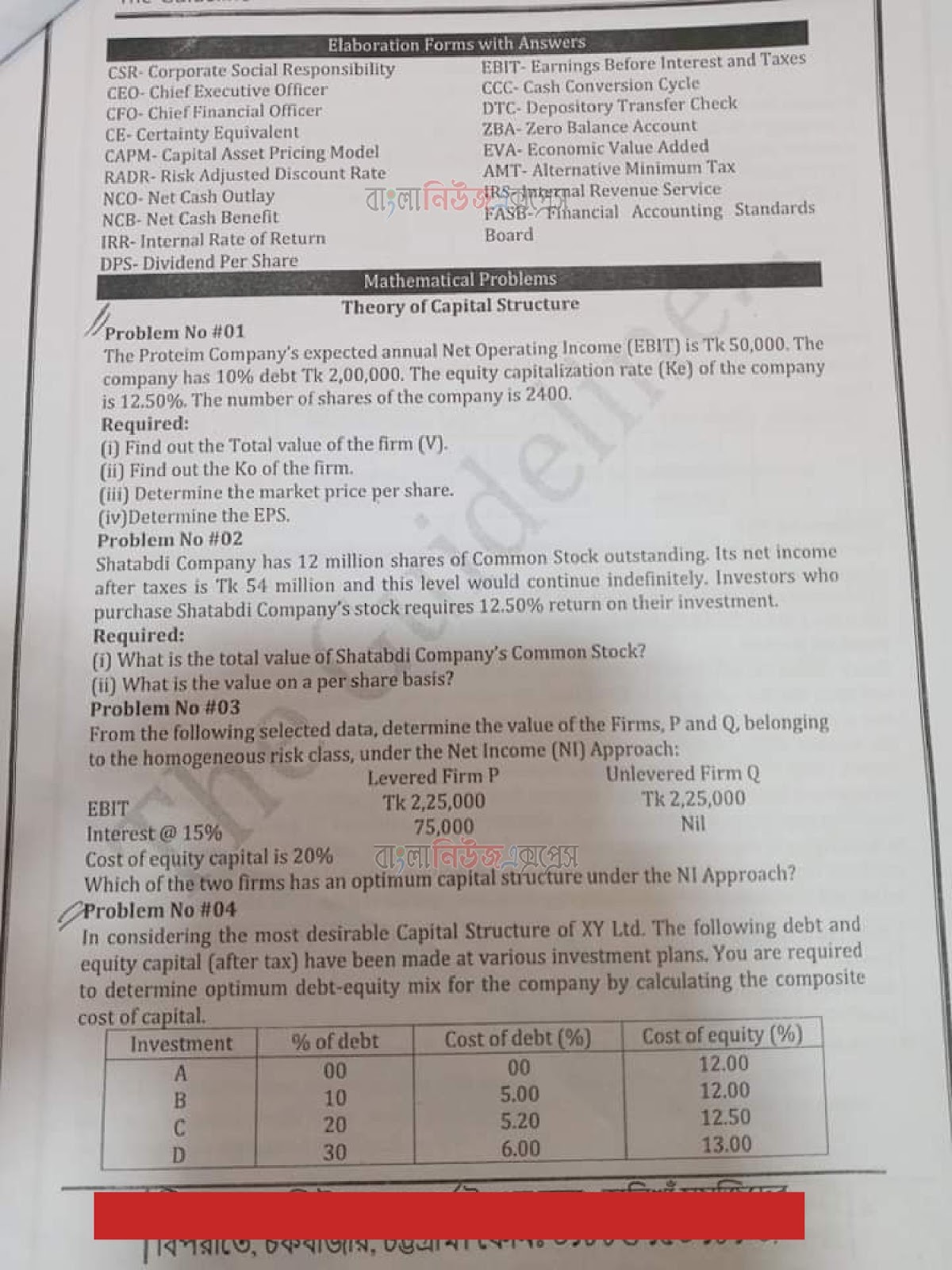

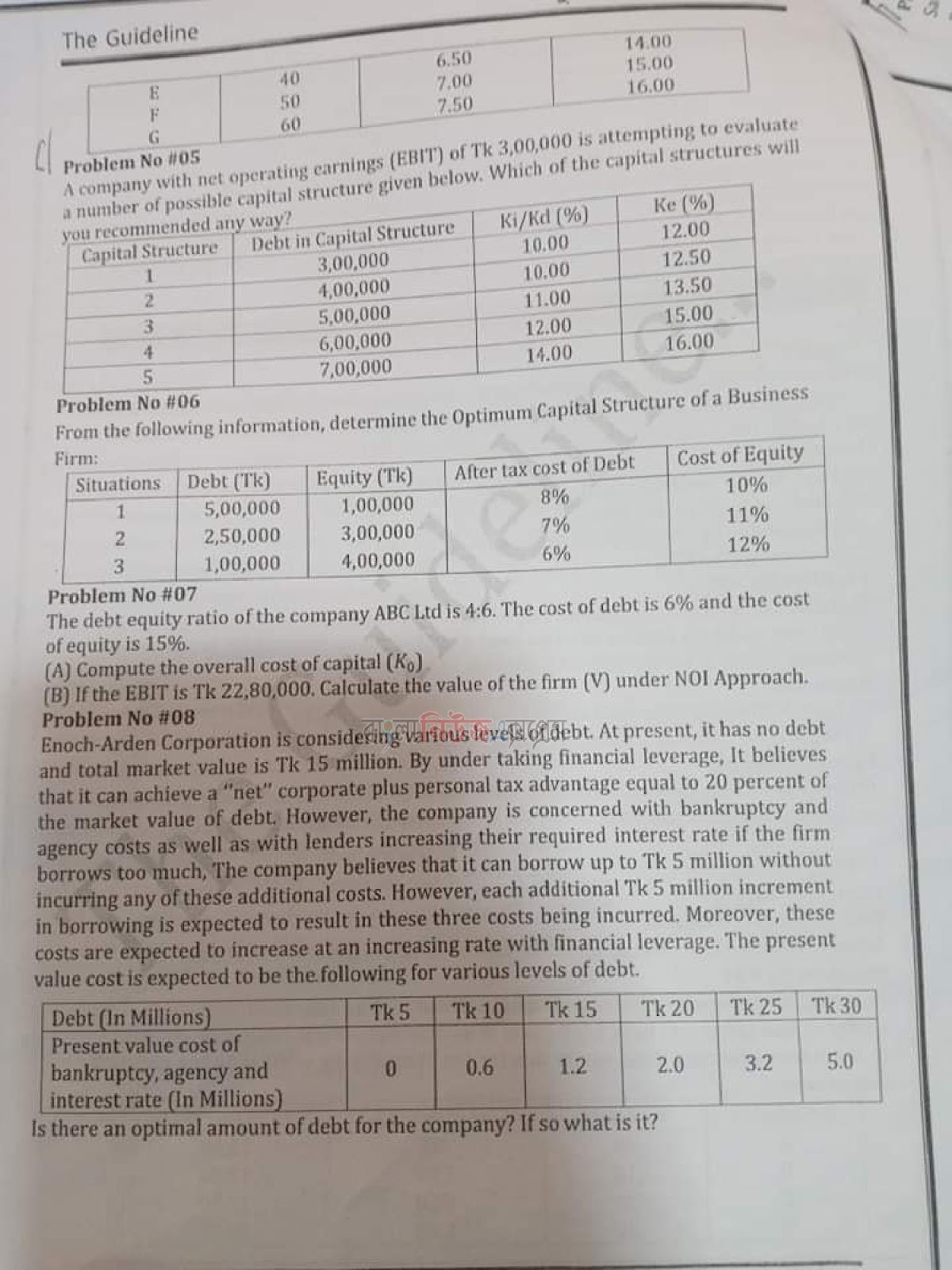

গ-বিভাগ : রচনামূলক প্রশ্ন

1. Moni Cotton Ltd. has 50,000 shares outstanding and each share is currently selling at Tk. 40. For the proposed R and D program the company needs to acquire and fund of Tk. 5,00,000. The financial manager of the company, Mr. Hossain wants to raise the required fund by offering right shares at Tk. 25 per share.

Requirements:

a. Number of new shares to be issued.

b. Number of rights needed to buy a new share of stock.

c. Value of right before ex-right.

2. The Star Industries limited has 5,00,000 shares outstanding at current market price of Tk. 130 per dshare. The company needs Tk. 20 million to finance the proposed project. The board of the company has decided to issue rights for raising the required money. The subscription (issue) price has been fixed at Tk. 100 per share.

a. How many rights required purchasing a new share?

b. Calculate the price of the share after right issue.

3. The stock of the Ocean Company is selling for Tk. od 150 per share. The company issues rights that allow the holders to subscribe for one additional share of stock at a subscription price of Tk. 125 a share for each nine rights held. Commute the theoretical value of the

following:

a. A right when the stock is selling “rights-on”;

b. One share of stock when is goes “ex-rights”.

4. Mr. Roy own five shares of XYZ Ltd. Common Stock. Market value of Stock is Tk. 70. Mr. Roy also have to Tk. 58 cash. He has just received word of a right offering. One new share can purchased at Tk. 58 for each 5 shares currently owned (based on 5 rights).

Required:

a What is value of rights?

b. What is the value of after right per share?

c. What is value of Mr. Roy portfolio before the right offering?

d. What is the value of Mr. Roy portfolio if the participate in the right offering?

5. Rahim Food Company is proposing a right offering. Presently there are 3,00,000 shares outstanding at tk. 80, each. There will be 60,000 new shares offered at Tk. 60 each.

Compute:

a. What is the new market value of the company?

b. How many rights are associated with one of the new shares?

c. What is the ex-right price? d. What is the value of a right?

e. Why might a company have a right offering rather than a general cash offer?

6. Mr. Rahman is thinking of acquiring a car for that purpose he is to decide whether the car is to be purchased through 12% borrowing or to be acquired on lease rent basis. The price of car is Tk. 7,00,000. Its annual maintenance costs are Tk, 45,000 per year and expected life is 5 years. It is assumed that the straight line method of depreciation is allowable under. Income Tax Act and tax rate is 35%. The salvage value of the car is Tk. 1, 00,000. In case of leasing the lease rental Tk. 3,00,000 for 5 equal annual installment (to be paid in advance) and maintenance expenses to be borne by lesser. Which alternative is to be selected by Mr. Rahman?

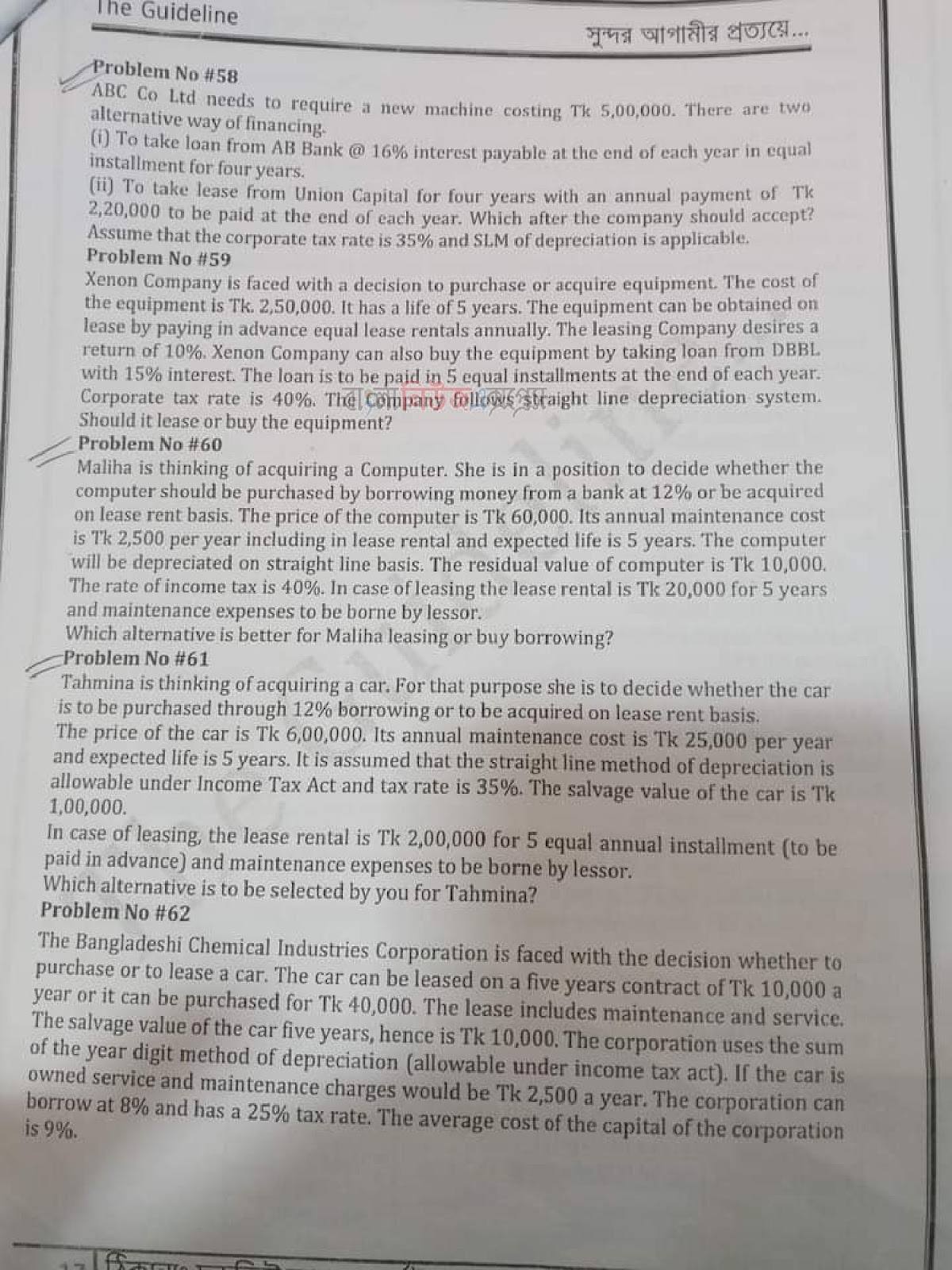

7. A company needs to acquire an equipment that will cost Tk. 3,35,220. The company has two alternatives to finance the equipment:

a. To take lease from United Leasing Company for 5 years with an annual lease payment of Tk. 1,20,000 to be paid at the end of each period.

b. To take loan from Janata Bank at 15% interest hmm p.a. repayable annually at the end of each of the 5 years in equal installments. The equipment will be depreciated on straight line basis. Corporate tax rate is 40%.

Which offer the company should accept?

8. Nissan Car Ltd. is faced with a decision to acquire on lease a mini car. The cost of mini car is Tk. 1,50,000. It has life of 5 year. The leasing company desire a return of 10% on the gross value of the asset.

Find out lease a rental instalment if-

i. To be paid at the beginning of each year.

ii. To be paid at the end of each year.

2025 আর্থিক ব্যবস্থাপনা অনার্স ৩য় বর্ষ সাজেশন পিডিএফ ডাউনলোড

part b & c.

- Discuss the factors influencing financial decision

- Discuss the umportance of capital budgeting

- Discuss the brief the techniques of capital budgeting

- Describe in berief the external factors determing capital structing

- which factors affecting dividend policy

- what factors affecting dividend policy

- what is zero coupon bonds. why do investors buy it although it has no coupon interst.

- Distinguish between common bond and stock

- explain best effort method and firm conmitment method of underwriting

- Discuss different methods of lease

- discuss the objectives of lease financing as orgabized in bangladesh

- explain the aggressive approach of working capital management

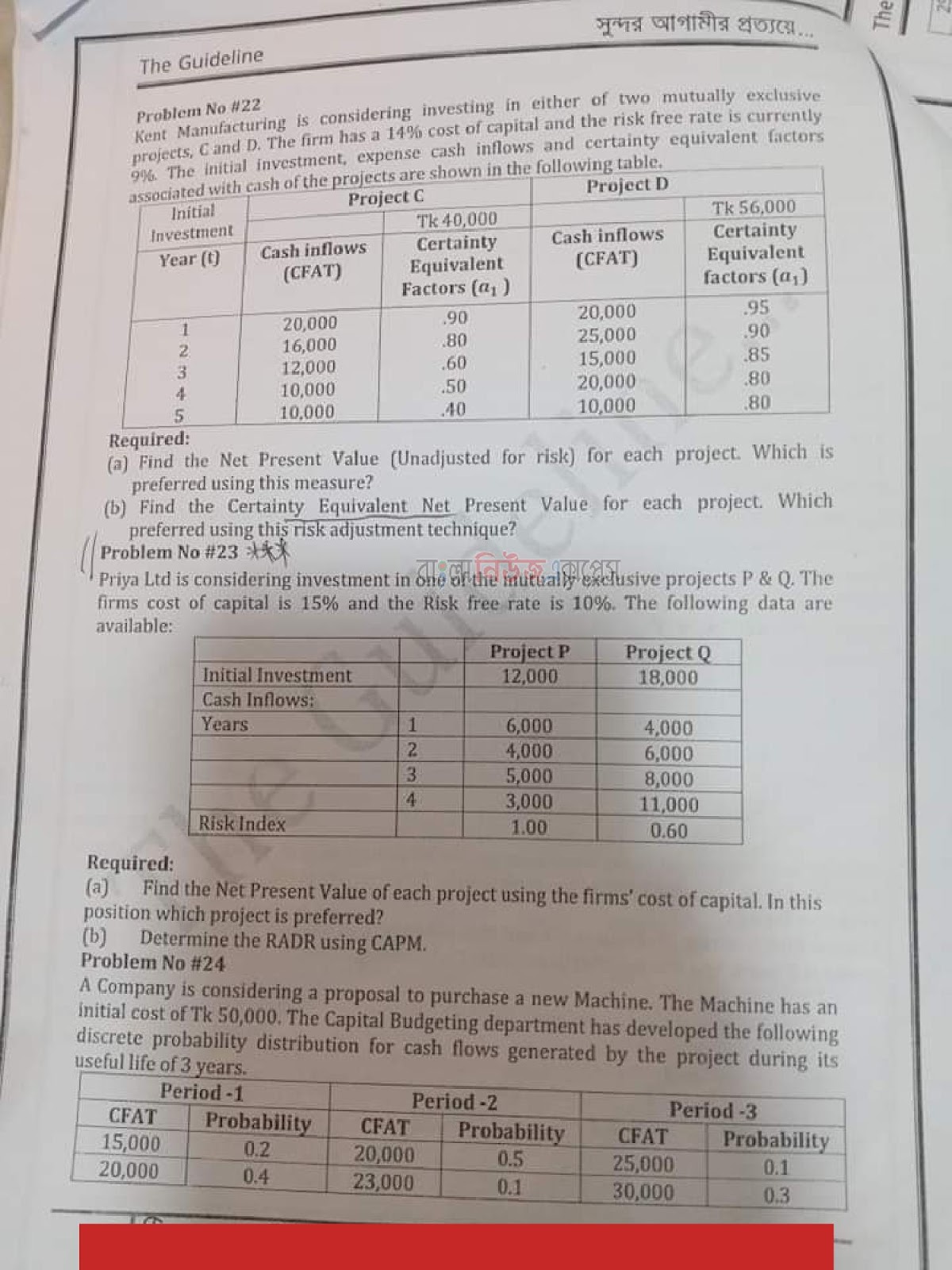

preynta computers is considering invesment in one of the mutually exclusive projects a and b. the cost — nu 12

priya ltd is considering invesment in one of the mutually exclusive projects p&q. the fiems cost of capital is 15% and the —- nu 17

the risk free rate of return is 11%:and the marker return is 16% .—- nu 18

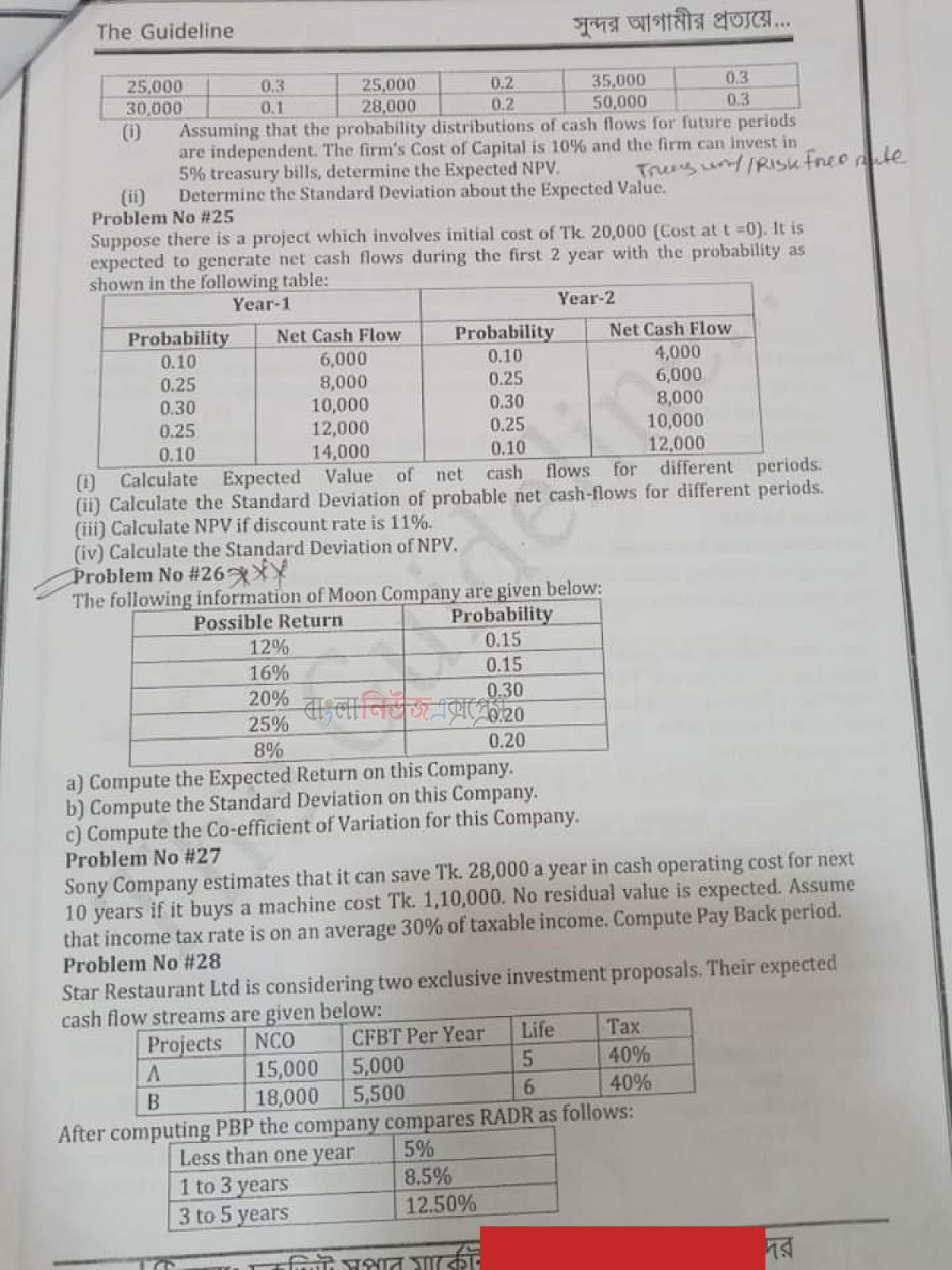

The probability distribution of npvs to two projects age given below — 18

two companies do you prefer and why — nu 13

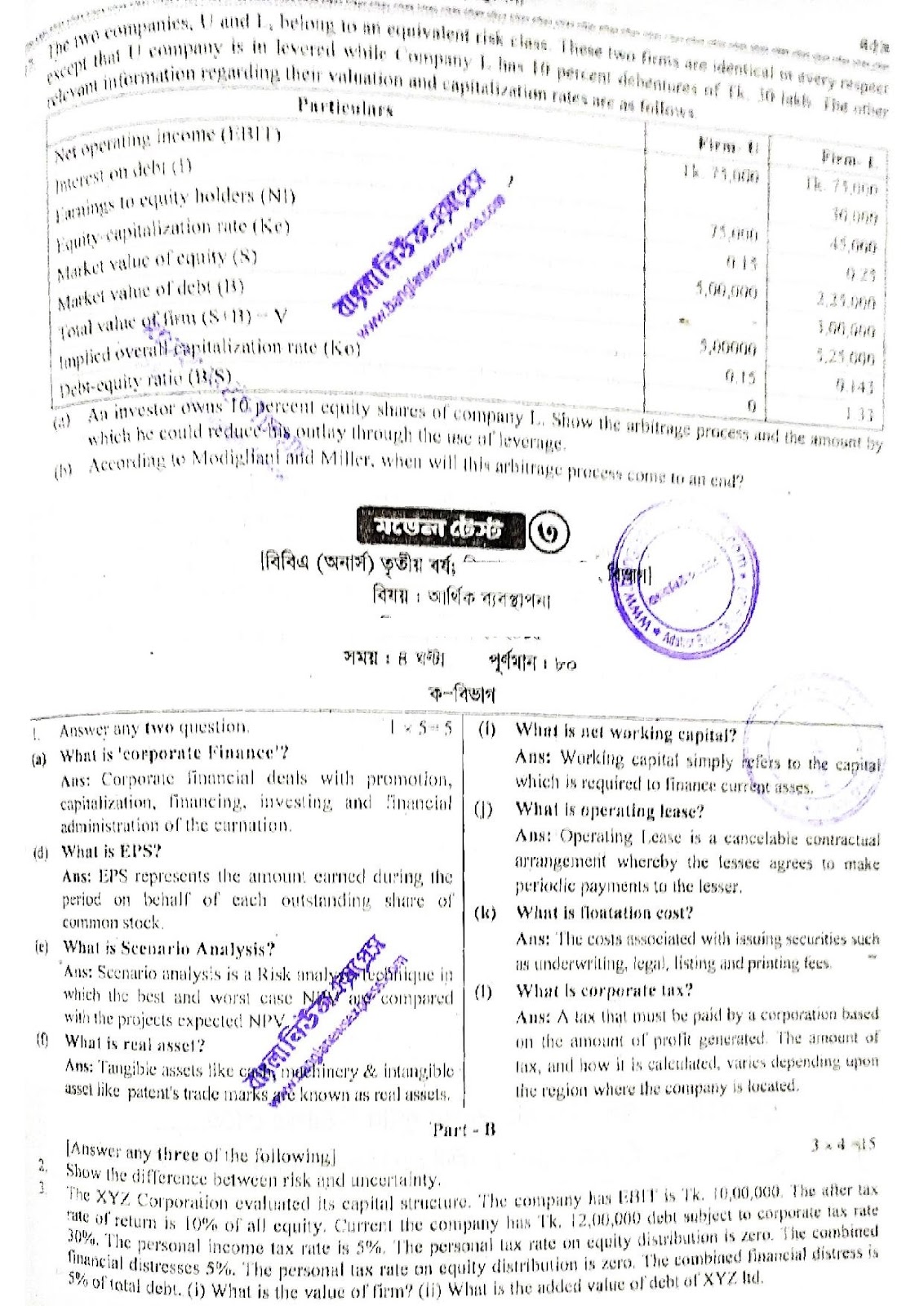

there are two companies you and l. where l is levered and I — nu 15

Sun limited with operating earning of taka 4.00.000 —nu 14

the two company l levered and u — nu 18

ench – abdern cororation is considering —nu 13

maria ltd has a cost if equity if 12% current market value—- nu 13

surma limited has a cost of equity of 12% — nu 13

the following information are available for apu company

nu 14

jain company ltd 20.00.000 common stock outstanding in the market and —nu 17

the following data are of keya cosmeticses ltd nu 14

moni cotton ltd has 50.000 shares outstanding and each is currently — nu 12

the star industries limited has 5.00.000— nu 14

The stock of the ocean company is selling for tk— nu 12

mr roy own five shares of xyz ltd common stock— nu 17

rahim food company is proosing a right offering presently there are 3.00.00 — nu 18

mr rahamab is thinking of acquiring a car for that— nu 13

a company needs to acquire an equire ab equipment that wil cost — nu 12

nisab car ltd is faced with a decision to acquire —nu 17

Abs ltd has been operating 24.000units of — nu 13

zebra company has average age of inventory of 60 days —- nu 15

pran rfl gives you the following information – nu 12

jamuna company has annual sales of tk 5 million cost — nu 14

the cost accountant provided with the following information— nu 17

[ বি:দ্র:এই সাজেশন যে কোন সময় পরিবতনশীল ১০০% কমন পেতে পরিক্ষার আগের রাতে সাইডে চেক করুন এই লিংক সব সময় আপডেট করা হয় ]

Google Adsense Ads

[ বি:দ্র:এই সাজেশন যে কোন সময় পরিবতনশীল ১০০% কমন পেতে পরিক্ষার আগের রাতে সাইডে চেক করুন এই লিংক সব সময় আপডেট করা হয় ]

[ বি:দ্র: নমুনা উত্তর দাতা: রাকিব হোসেন সজল ©সর্বস্বত্ব সংরক্ষিত (বাংলা নিউজ এক্সপ্রেস)]

2025 জাতীয় বিশ্ববিদ্যালয়ের এর 2025 অনার্স ৩য় বর্ষের আর্থিক ব্যবস্থাপনা পরীক্ষার সাজেশন, 2025 অনার্স তৃতীয় বর্ষ আর্থিক ব্যবস্থাপনা সাজেশন

Honors 3rd year Common Suggestion 2025

আজকের সাজেশান্স: Honors Financial Management Suggestion 2025,আর্থিক ব্যবস্থাপনা চূড়ান্ত সাজেশন 2025

Google Adsense Ads