Google Adsense Ads

চূড়ান্ত সাজেশন অনার্স ৪র্থ বর্ষের আর্থিক ব্যবস্থাপনা, অনার্স ৪র্থ বর্ষের ১০০% কমন আর্থিক ব্যবস্থাপনা সাজেশন অনার্স ৪র্থ বর্ষ আর্থিক ব্যবস্থাপনা সাজেশন, honors 4th year finance management special short suggestions, অনার্স ৪র্থ বর্ষ আর্থিক ব্যবস্থাপনা ১০০% কমন সাজেশন, Honors 4th year suggestions

অনার্স ৪র্থ বর্ষের আর্থিক ব্যবস্থাপনা সাজেশন 2025

| জাতীয় বিশ্ববিদ্যালয় অনার্স পাস এবং সার্টিফিকেট কোর্স ৪র্থ বর্ষের BA, BSS, BBA & BSC অনার্স ৪র্থ বর্ষের [২০১৩-১৪ এর সিলেবাস অনুযায়ী] আর্থিক ব্যবস্থাপনা (Financial Management (In English) ) সুপার সাজেশন Department of : Management & Other Department Subject Code: 242603 |

| ২০২৫ এর অনার্স ৪র্থ বর্ষের ১০০% কমন সাজেশন |

অনার্স ৪র্থ বর্ষের আর্থিক ব্যবস্থাপনা সাজেশন,আর্থিক ব্যবস্থাপনা অনার্স ৪র্থ বর্ষ সাজেশন, চূড়ান্ত সাজেশন অনার্স ৪র্থ বর্ষের আর্থিক ব্যবস্থাপনা, অনার্স ৪র্থ বর্ষের আর্থিক ব্যবস্থাপনা ব্যতিক্রম সাজেশন pdf, অনার্স ৪র্থ বর্ষের ১০০% কমন আর্থিক ব্যবস্থাপনা সাজেশন,

অনার্স ৪র্থ বর্ষের পরীক্ষার সাজেশন ২০২৫ (PDF) লিংক

সর্বশেষ সংশোধিত ও সাজেশন টি আপডেটের করা হয়েছে ২০২৫

আর্থিক ব্যবস্থাপনা অনার্স ৪র্থ বর্ষ সাজেশন 2025

ক-বিভাগ: অতিসংক্ষিপ্ত প্রশ্নের উত্তর

1. What is business finance?

Ans. Business Finance may be defined as the process SIT of raising, providing and managing of all the money to be used in connection with business activities.

2. What is agency cost?

Ans. The cost borne by the stockholders to maintain a governance structure that maximizes agency problems and contributes to the maximization of owner wealth.

3. What is rick premium?

Ans. The excess return required from an investment in a likely assets over that required from a risk free investment.

4. What is financial structure?

Ans. The financial structure of a firm means the total of all liabilities and ownership claims the sum of what is usually the credit side of the balance sheet.

5. What is financial leverage?

Ans. We can define financial leverage as the potential use of fixed financial costs to magnifz the effects of changes before interest and taxes on the firm’s earnings per share.

6. What is dividend policy?

Ans. Dividend policy is the firms plan of action to be followed whenever a dividend decision in made.

7. What is floatation cost?

Ans. The costs associated with issuing securities such as underwriting legal, listing, and printing fees.

8. What is reverse stock split?

Ans. Reverse stock is a method used to raise the market. price of a firm’s stock by exchanging a certain number of outstanding shares for one new share.

9. What is pre-emptive right?

Ans. The privilege of the shareholders to maintain their proportional company ownership by purchasing a proportionate share of any new issue of common stock, or securities convertible into common stock.

10. What is private placement?

Ans. A private placement is the sale of stock to only one or a few investors, usually institutional investors.

11. What is ‘corporate Finance’?

Ans. Corporate financial deals with promotion, capitalization, financing, investing and financial administration of the carnation.

12. What is EPS?

Ans. EPS represents the amount earned during the period on behalf of each outstanding share of armmon stock.

13. What is Scenario Analysis?

Ans. Scenario analysis is a behavioral approach similar to sensitivity analysis but broader in scope.

14. What is real asset?

Ans. Tangible assets like cash, machinery & intangible asset like patent’s trade marks are known as real assets.

15. What is net working capital?

Ans. Net working capital refers to the difference between current assets and current liabilities.

16. What is operating lease?

Ans. Operating lease is short-term lease used to finance asset and is not fully amortized over the life of the asset.

17. What is risk?

Ans. Risk is the financial loss or more formally, the variability of returns associated with a given assets.

18. What is corporate tax?

Ans. A tax that must be paid by a corporation based on the amount of profit generated. The amount of tax, and how it is calculated, varies depending upon the region where the company is located.

19. What is NPV?

Ans. Net Present value.

20. What is RADR?

Ans. Risk adjusted discount rate is the discount rate that reflects the risk of a particular capital budgeting project.

21. What is sensitivity analysis?

Ans. Sensitivity analysis indicates exactly how much NPV will change in response to given change in an input variable, other things held constant.

22. What is capital structure?

Ans. Capital structure refers to the mixture of long term sources of debt and equity funds.

23. What is NI approach?

Ans. The (NI) approach was a advocated by David Durand. Capital structure decision is considered as relevant in eased valuation of the firm under this model.

24. What do you mean wealth maximization?

Ans. Wealth maximization means that maximizing the profit of the firm.

| Honors Suggestion Links | প্রশ্ন সমাধান সমূহ |

| Degree Suggestion Links | BCS Exan Solution |

| HSC Suggestion Links | 2016 – 2025 জব পরীক্ষার প্রশ্ন উত্তর |

| SSC Suggestion Links | বিষয় ভিত্তিক জব পরিক্ষার সাজেশন |

আর্থিক ব্যবস্থাপনা অনার্স ৪র্থ বর্ষ সুপার সাজেশন PDF Download 2025

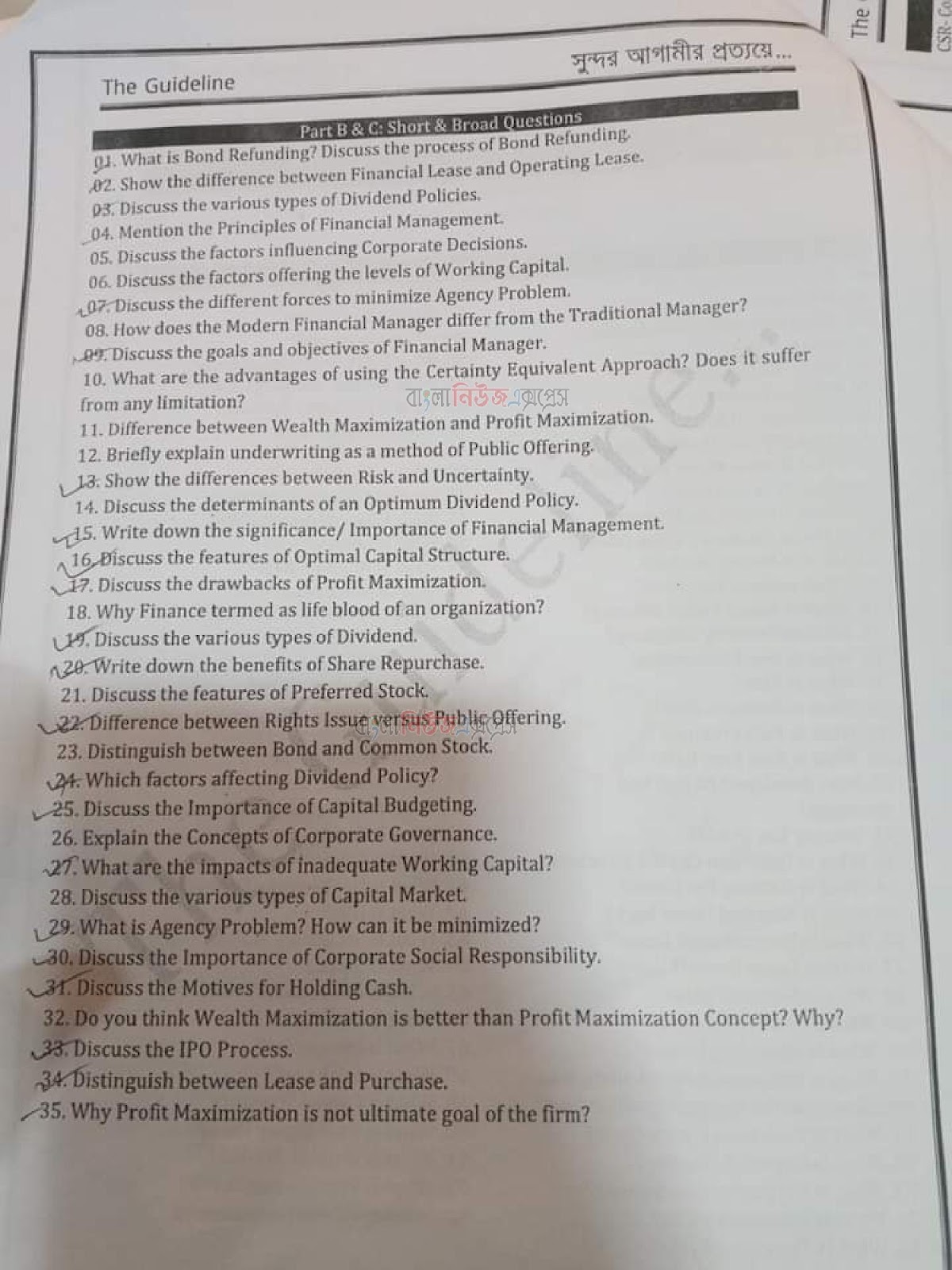

খ-বিভাগ: সংক্ষিপ্ত প্রশ্ন

1. Discuss the factors affecting the level of working capital.

2. Differences between rights issue versus public offering.

3. The following information relate to Israt commpany Kanpersky Network Security Co. Ltd.

P/E Ratio = 5 times

EPS = Tk. 25

DPS = Tk. 15

R=10%

Required: (using Gordon model)

(a) Ke (Capitaliation rate)

(b) D/P Ratio (Divident payout ratio)

(c) Po (Market price per share)

4. Write short notes on CAPM.

5. Discuss the corporate decision.

6. A company want to invest in a project the initial outlay of which is Tk. 27,000. The relevant cash flows of the project is given below: (ছকটি PDF উত্তরমালায় দেখানো হয়েছে।) The firm cost of capital is 14% Calculate : Internal Rate of Return (IRR)

7. Company A and B are identical in every respect A is Unlevered while B has Tk. 5,00,000 of 10% debt outstanding EBIT Tk. 4,00,000 and corporate tax 40%. Equity holders required rate of return 15%

8. Value of unlevered firm.

9. Gain from leverage.

10. Value of levered firm.

[ বি:দ্র: উত্তর দাতা: রাকিব হোসেন সজল ©সর্বস্বত্ব সংরক্ষিত (বাংলা নিউজ এক্সপ্রেস)]

11. Discuss the internal factors affecting financial decisions.

12. What is risk return trade off?

13. What is the financial goal of a firm?

14. Discuss the key activities of financial manager.

15. Distinguish between capital structure and financial structure.

16. Chitra Secretariat Secretariat Services is considering, M and N. Both are expected to provide benefits over a 10 year period, and each has a required investment of Tk. 3000. The firm uses a 10 percent cost of capital. Management has constructed the following table of estimates of annual cash inflows for pessimistic, most likely and optimistic results. (ছকটি PDF উত্তরমালায় দেখানো হয়েছে।) Construct a table similar to this for the NPVs associated with each outcome for both computers.

11. Describe the elements of lease financing.

12. Show the difference between risk and uncertainty.

13. Briefly explain the arguments in favor of profit maximization.

14. Briefly discuss different types of dividend policies.

15. What is the difference between Gross working capital & Net working capital?

16. Consider the following information for Kajal Ltd. (ছকটি PDF উত্তরমালায় দেখানো হয়েছে।) What will be the value of Kajal Ltd. according to the Modigliani and Miller approach?

PDF Download আর্থিক ব্যবস্থাপনা অনার্স ৪র্থ বর্ষ সুপার সাজেশন 2025

গ-বিভাগ: রচনামূলক প্রশ্ন

1. (a) What is financial Management?

(b) Disuss the importance of Financial Management.

2. (a) Show the differces between risk and Uncertainty.

(b) Discuss in brief the techniques of capital budgeting.

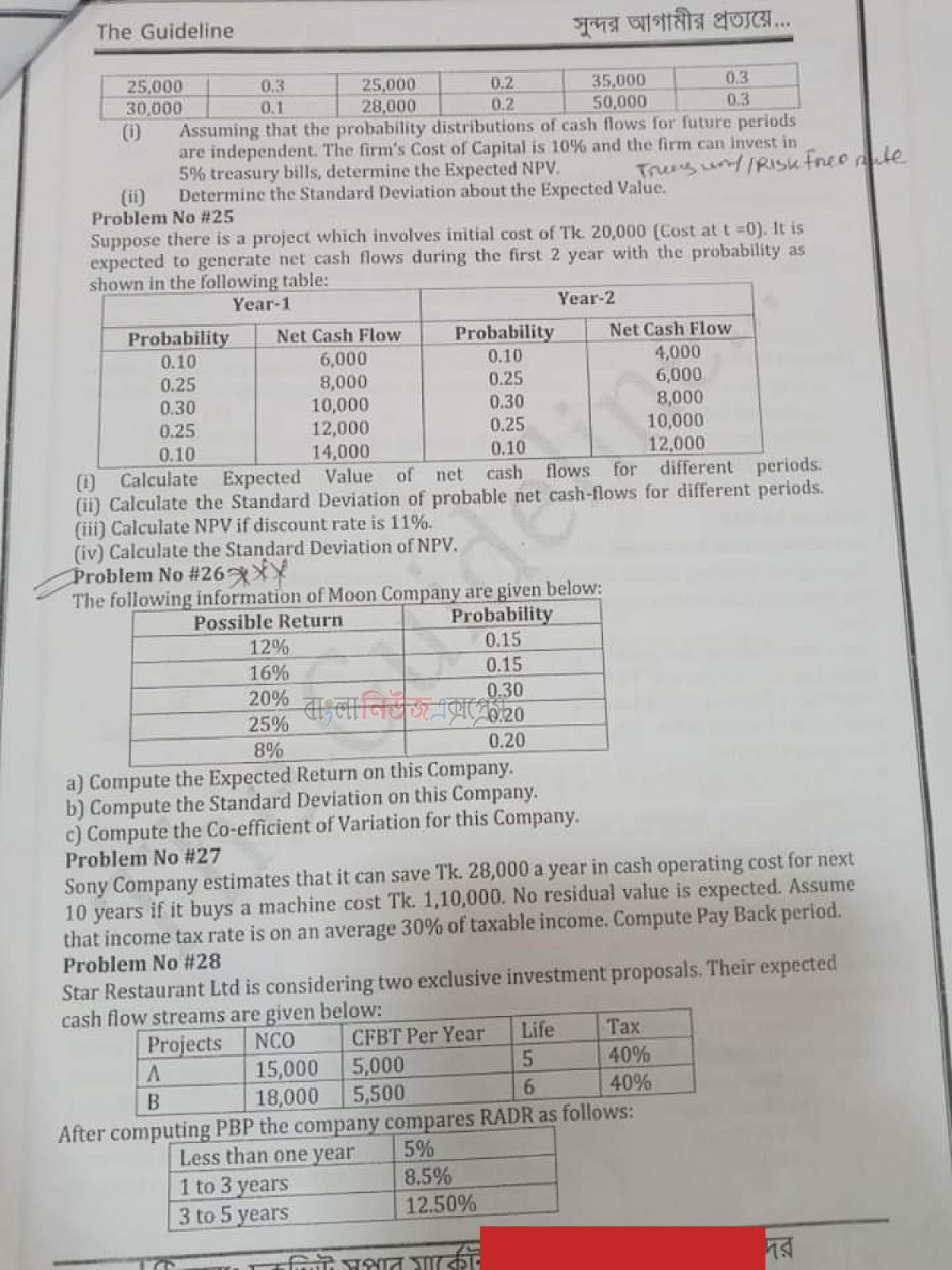

3. Haradhan Company is considering two mutually exclusive projects. A and B costing Tk. 30,000 and Tk. 36,000 respectively following are the expected net present value (NPV) and probability distribution of two projects. (ছকটি PDF উত্তরমালায় দেখানো হয়েছে।)

You are required to calculate.

(a) Expected NPV of both the project.

(b) Standard Deviation of both project.

(c) Which project is more risky and which project should be selected.

4. Discuss the different types of agency cost.

5. How do you deal with the agency problem?

6. Discuss the simulation, Decision tree approach and probability distribution approach.

7. Discuss about NI and NOI approach.

8. (a) What is IPO.

(b) Discuss the SEC regulation in the secondary market?

9. The earnings per share of a company are Tk. 10 It has an internal rate of return 15% and the capitalization rate of its risk class is 12.50%.

Required (using Walter model):

(i) What should be the optimum payment ratio of the firm?

(ii) What should be the price of the share at this payout ratio?

(iii) How shall the price of the share be affected if different payout where employed?

10. In considering the most desirable capital structure of Bight Company, the following estimates of cost of debt and equity capital (after tax) have been mode at various levels of debt-equity mix. (ছকটি PDF উত্তরমালায় দেখানো হয়েছে।)

You are required to determine the optimal debt-equity mix for the company by calculating the composite cost of capital.

11. Why wealth maximization is considered as the prime goal of a firm?

12. (a) Explain the process of public issue.

(b) A firm is thinking of a rights issue to raise Tk. 5 crore

It has a 5 lakh shares outstanding and the current O market price of the share is Tk. 170. The subscription price on the new share will be Tk. 125 per share.

(i) How many shares should be sold to raise the required funds?

(ii) How many rights are needed to purchase one new share?

(iii) What is the value of one right?

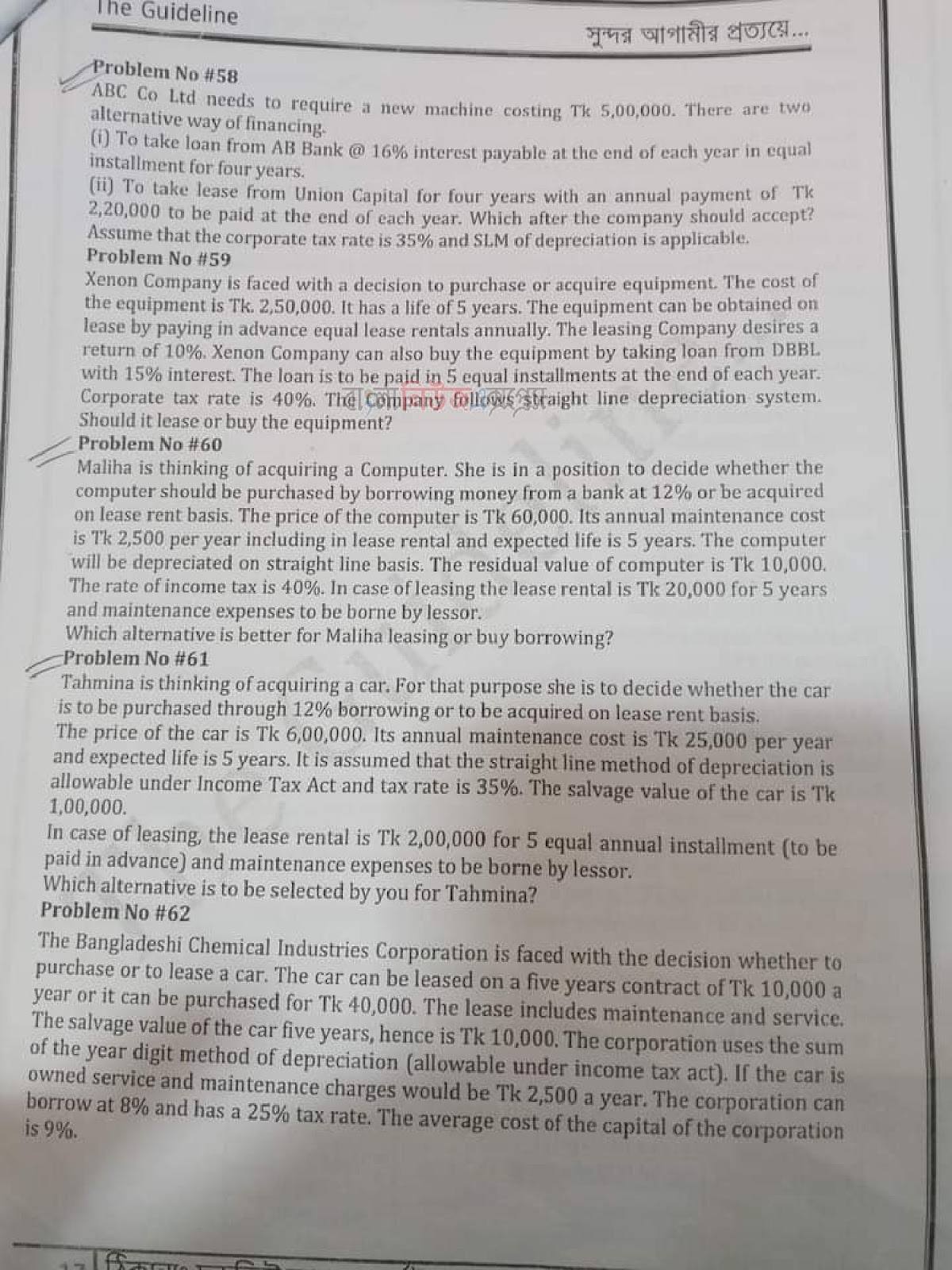

13. Romana Afroz is thinking of acquiring a car. For that purpose she is to decide whether the car is to be purchased through 12% borrowing or to be acquired on lease rent basis. The price of the car is Tk. 6,00,000. Its annual maintence cost is Tk. 25,000 per year and expected life is 5 Years. It is assumed that the straight line method of depreciation is allowable under income Tax Act and tax rate is 35%. The salvage value of the car is Tk. 1,00,000. In case of leasing, the lease rental is Tk. 2,00,000 for five equal annual installment (to be paid in advance) and maintence expenses to be borne by leassor.

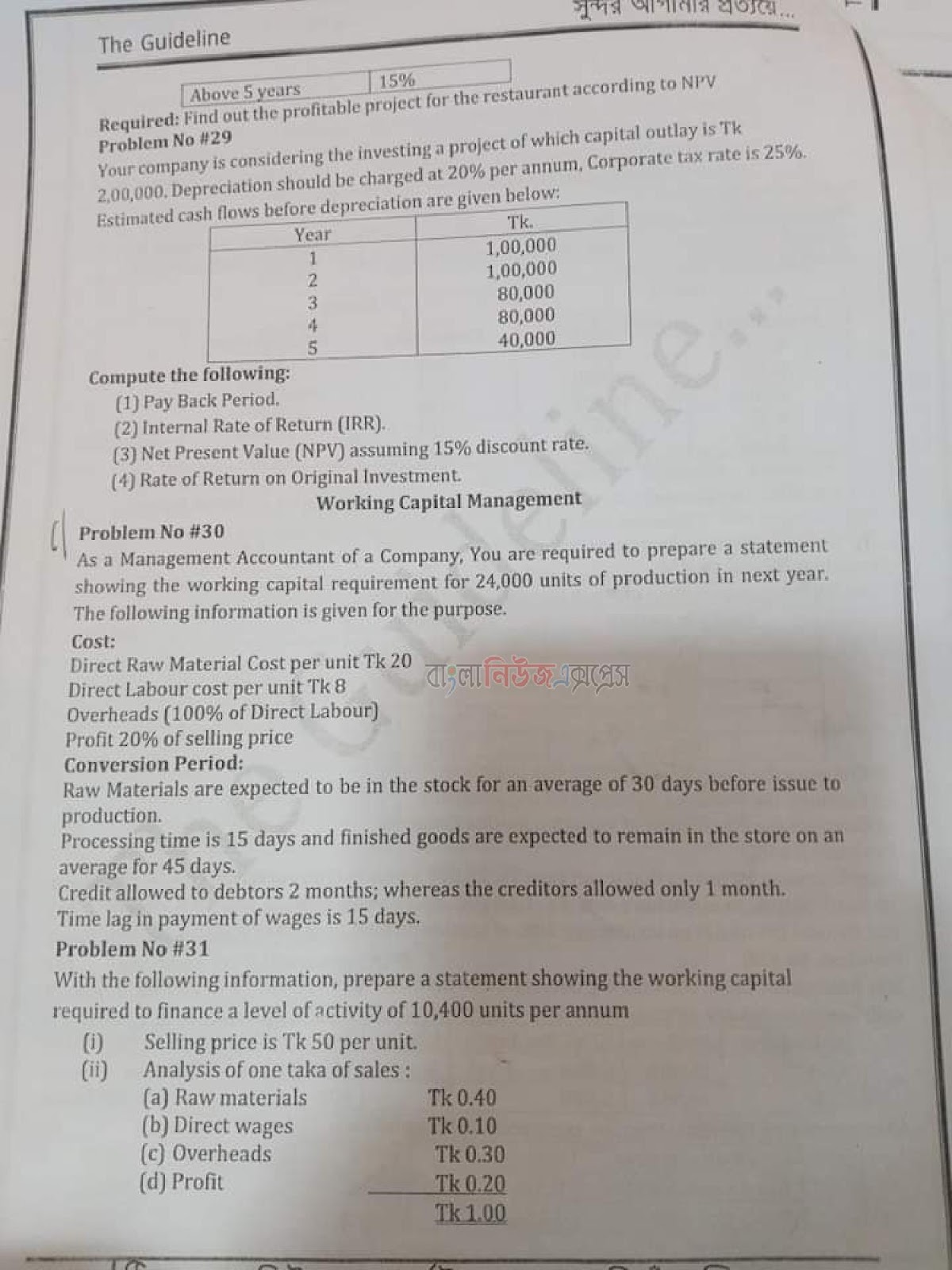

14. Prepare a statement to determine the working capital requirement from the following information:

(i) Expected sales 36,000 units per annum.

(ii) Analzsis of selling price:

Per unit (Tk.)

Raw materials 6

Labor 4

Overhead 3

Profit 2

Selling price 15

(iii) Additional information:

Raw materials remain in stores on an average 1 month. Processing time is 2 months.

Finished goods are kept in store 3 months.

Credit allowed to debtors 4 months.

Credit allowed by suppliers 2 months.

Wages and overhead are paid twice in a month on the 1st and on the 16th.

Production is carried on evenly during the year and wages & expenses accrue in the same way.

15. Maliha is thinking of acquiring a computer. She is in a position to decide whether the computer should be purchased by borrowing money form a bank at 12% or be acquired on lease rent basis. The price of the computer is Tk. 60,000. Its Annual maintenance cost is Tk. 2,500 per year including ink lease rental and expected life is 5 years. The computer will be depreciated on straight line basis. The residual value of the computer is Tk. 10,000. The rate of income tax is 40%. In care of leasing, the lease rental is Tk. 20,000 for 5 year and maintenance expenses to be borne by lessor.

Which alternative is better for Maliha, leasing or buy borrowing?

16. Brishti Ltd Company provides the following particulars to determine the required amount of working capital of a company: (ছকটি PDF উত্তরমালায় দেখানো হয়েছে।)

Raw materials are in stock, on an average 1 month. Materials are in process, on and average, half month, finished goods are in stock, on an average, 1 month. Credit allowed by suppliers goods is 1 month; credit allowed to debtors is 2 month. Lag in payment of wages is one-a-helf weeks; Tag payment of overhead is 1 month. One fourth of output is sold against cash. Cash in hand is expected to be Tk. 2,500. Annual production is expected to be 1,04,000 units. You may assume that production is carried of evenly throughout the year and wages and overheads accrue similarly.

2025 আর্থিক ব্যবস্থাপনা অনার্স ৪র্থ বর্ষ সাজেশন পিডিএফ ডাউনলোড

A part

what is Finance?

Define corporation?

What is agency cost?

what is public Finance?

What is agency problem?

who are involves in corporate governance?

what is risk?

Hon.s 4th year suggestion 2020 Finance Management

what is the risk in capital budgeting

what is expected value?

What is an opportunity cost?

what is capital rationing?

define similation.

what is the rquation of finance structure?

what is trading equity?

what is bsec

what is indifference point?

what is EPS?

what is optimum capital structure?

what do you mean by growing company

what is dividend policy?

what is target dividend payout ratio?

what is reverse stock split?

what is stock divudend?

what is green shoe provision?

what is common stock?

what is pre – emptive right.

what is privileged subscription?

what is right offering?

what is sale and leaseback?

what is leveraged lease?

what is hire purchase?

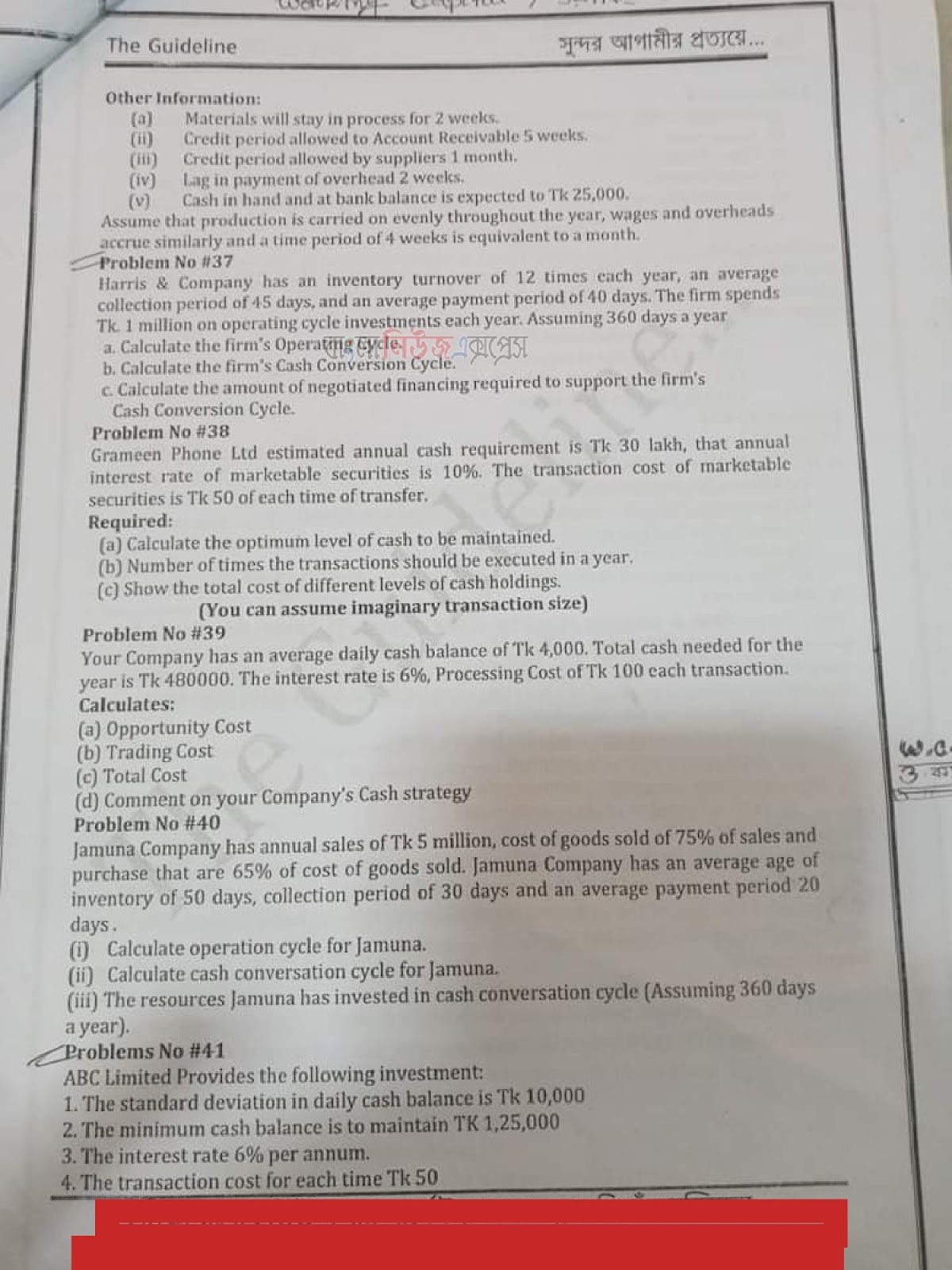

what is cash conversion cycle?

what is are sources of spontaneous financing?

what is EOQ?

What is trade credit?

what is venture capital?

B Part

Discuss the goals and objectives of a financial manager?

What ia agency problem? How can it be minimized

what is finance termed as life blood of an industry?

Distinguish between capital budgeting& capital rationing

write down the short notes on CAPM abd write the formula of it

Differenentiate betwen net income (NI) approach and Net operating income (NOI) approach.

show the difference betwen cash dividend and stock dividend.

Briefly explain underwriting as a method of public offering.

Give the defination of lease financing.

Ananda corporation wishes to calculate ist cost of common stock using CAPM. its investment managers analysis indicates that the risk free of return equals 7% the cor porations beta equals 1.5 and the market return equals11%

Calculate the market risk premium and cost of equity capitl.nu 17

sony Company estimates that it can save tk 28.000 a yeae in cash operating cost for next 10 years if it buys a macine cost tk 1.10.000. no residual valu is expected.Assume that income tax rate is on an average 30% of taxable income

Compute payback period nu 18

Taj co ltd has tk 15.00.000 debt capital in its capital structure.Their expected net operating income is tk 5.00.000. rate of interest is 6% overall cost of capital is 12% .the company hss 5000 equity shares nu 17

chitra company proposing a right offering persently there are 4.00.000 shares outstanding at tk 75 cash .There Will be 70.000 new shares offeeed at tk 70 cach. nu 17

mitu cotton ltd has 50.000 shares outdstanding. the stock for 40 per share.to raise tk.5.00.000 for a new partial accelerator.the firm is considering a rughts offering at tk 25 per share. nu 18

cost of an asset is tk 25 lakh a 6 years lease of the asset is proposed to yied 100% return to the lessore ignoring taxes.The salvage value is tk 1.00.000.

Determine equal lease rental if payments are made quarterly.

Mr ahnaf has taken a loan of tk 10.00.000 form a bank after 10 years he has given the bank tk 17.00.00.

Calculate die rate of interest if jnterest cimpounded yearly.

part c

Discuss the functions of financial management.

Briefly discuss the qualities of financial manager.

Discuss in brief the techniques of capital budgeting.

what are the advantagea of using form any limitation.

Discuss the sources of risk

wtite down the features of optimum capital structure.

Discuss the IPO process.

Describe the elements of lease financing.

Discuss the objectives of lease financing as orgaized in bangladesh.

explain the impact of financial leasing on the cash flow of a firm.

Distinguish betwen lease and purchase.

What is working capital? Briefly discuss various policies of financing working capital.

define working capital management. why it is important to study management of working capital as a separate area in financial management.

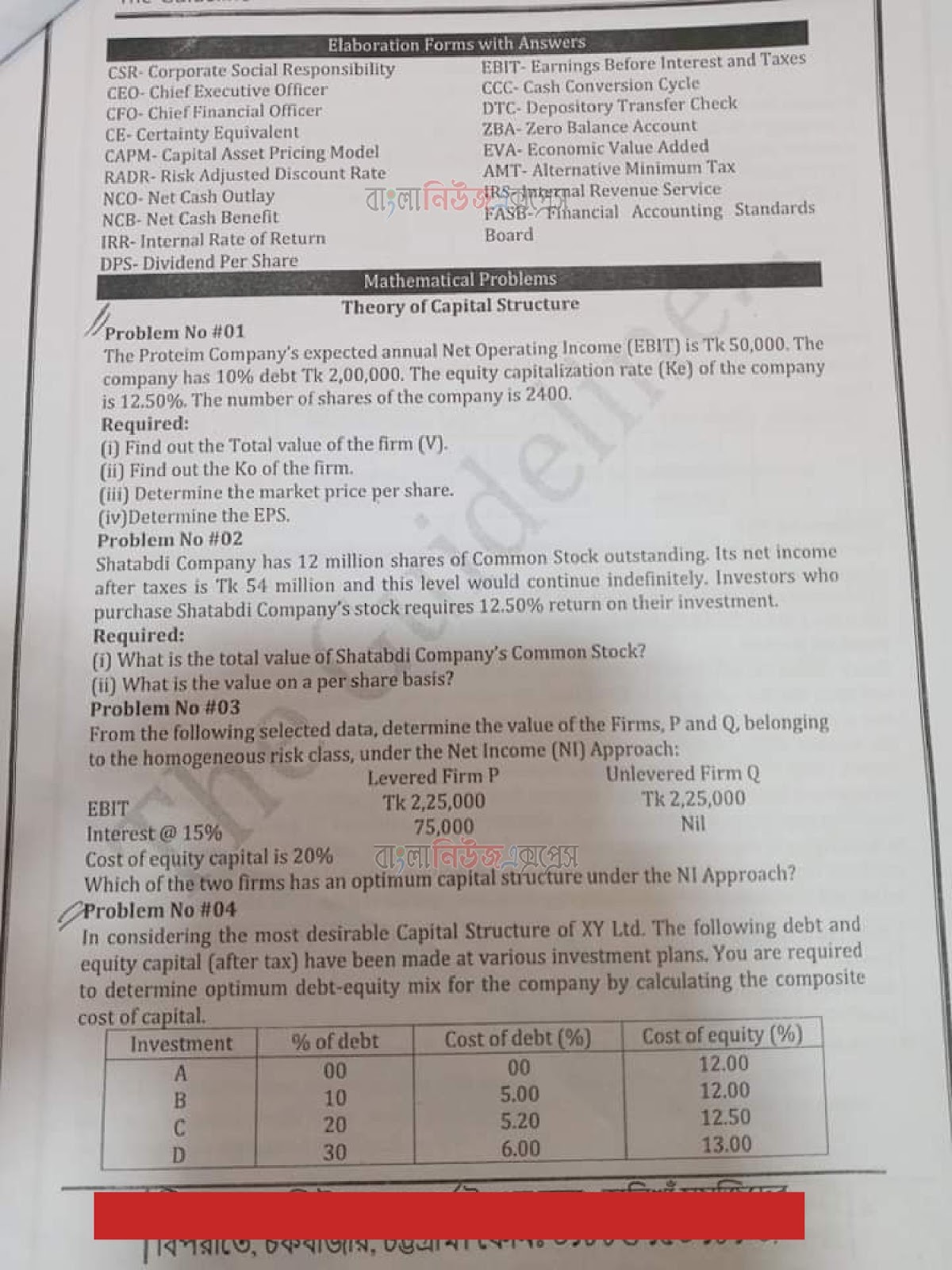

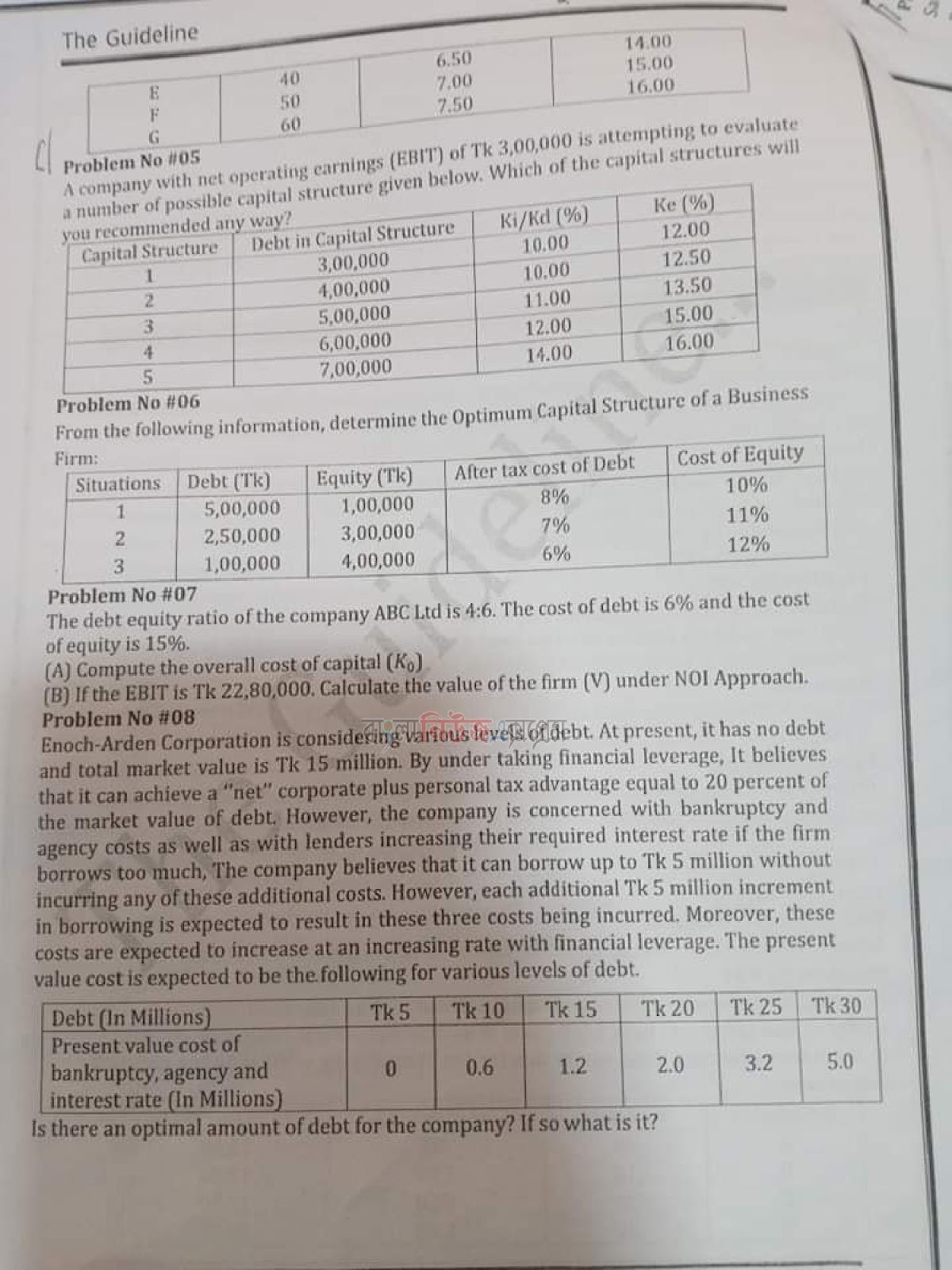

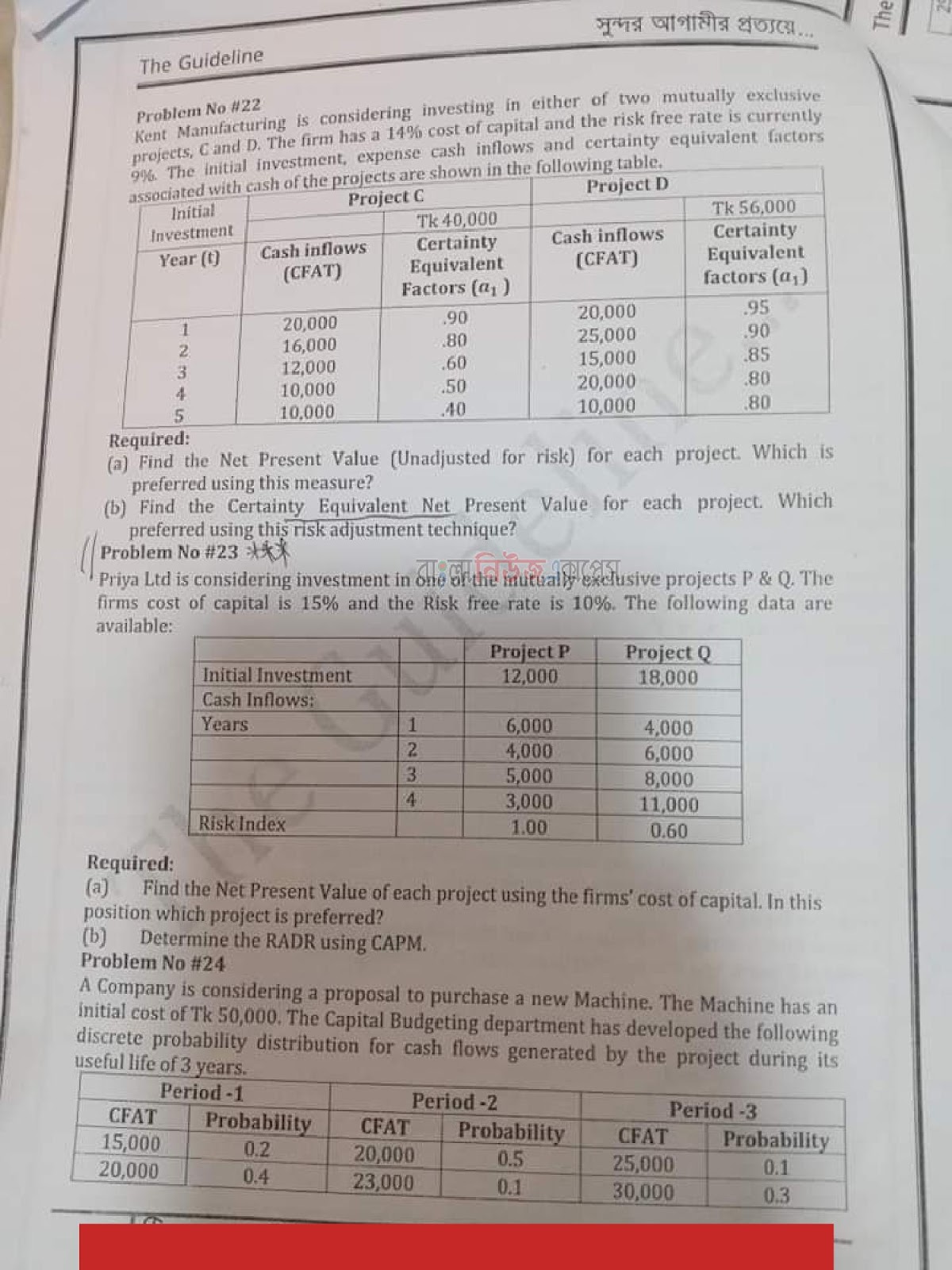

ম্যাথ

The following information of Bashundhara company nu 18

The following is data regarding two companies SUN and MOON belonging to the same risk class. nu 17

Hillary inc is propising a rights offering presently they have 2.40.000 shares outstanding at tk 80 each. there will be 60.000 new shares offered at tk 80 each. there will be 60.000 new shares offered at tk 60 each. nu 16

MNo manufacturing company is going to undartake a project which will have a monthly production of 20.000 units of a product —++++++++ nu 17

Google Adsense Ads

২০২৫ জাতীয় বিশ্ববিদ্যালয়ের এর 2025 অনার্স ৪র্থ বর্ষের আর্থিক ব্যবস্থাপনা পরীক্ষার সাজেশন, 2025 অনার্স চতুর্থ বর্ষ আর্থিক ব্যবস্থাপনা সাজেশন

Honors 4th year Common Suggestion 2025

আজকের সাজেশস: অনার্স ৪র্থ বর্ষের আর্থিক ব্যবস্থাপনা স্পেশাল সাজেশন 2025,Honors Financial Management (In English) Suggestion 2025

PDF Download আর্থিক ব্যবস্থাপনা অনার্স ৪র্থ বর্ষ সুপার সাজেশন, আর্থিক ব্যবস্থাপনা অনার্স ৪র্থ বর্ষ সাজেশন পিডিএফ ডাউনলোড, আর্থিক ব্যবস্থাপনা সাজেশন অনার্স ৪র্থ বর্ষের, অনার্স ৪র্থ বর্ষ আর্থিক ব্যবস্থাপনা সাজেশন, আর্থিক ব্যবস্থাপনা অনার্স ৪র্থ বর্ষ সাজেশন,

Google Adsense Ads

Honors 4th-year financial management suggestion 2023 কোড -২৪২৬০৩ এর সাজেশন প্রয়োজন ২০২৩ সালের

এটাই